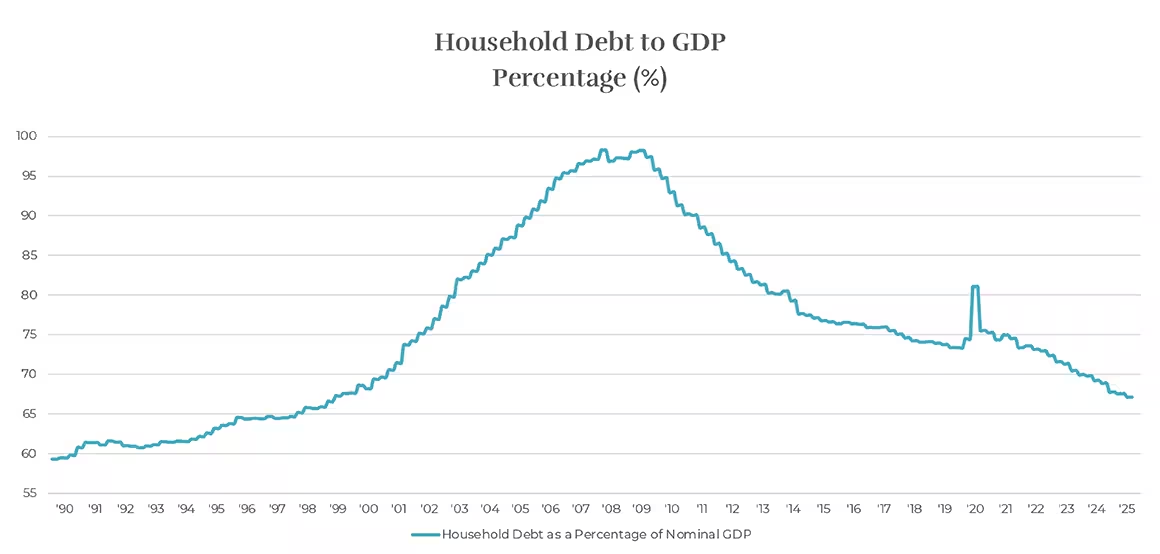

Automation and AI are reshaping production, reducing reliance on offshoring and bolstering domestic competitiveness. While labor market risks linger, equilibrium between job openings and seekers suggests stability. Tariff-related inflation appears to be fading, leaving the U.S. positioned to outperform other developed economies, even as China and India lead emerging markets. In the meantime, households have deleveraged, as shown in Figure 1.

Figure 1: Household Debt to GDP Percentage (%)

Source: Cetera Investment Management, FactSet, U.S. Bureau of Economic Analysis. Data as of 6/30/2025.

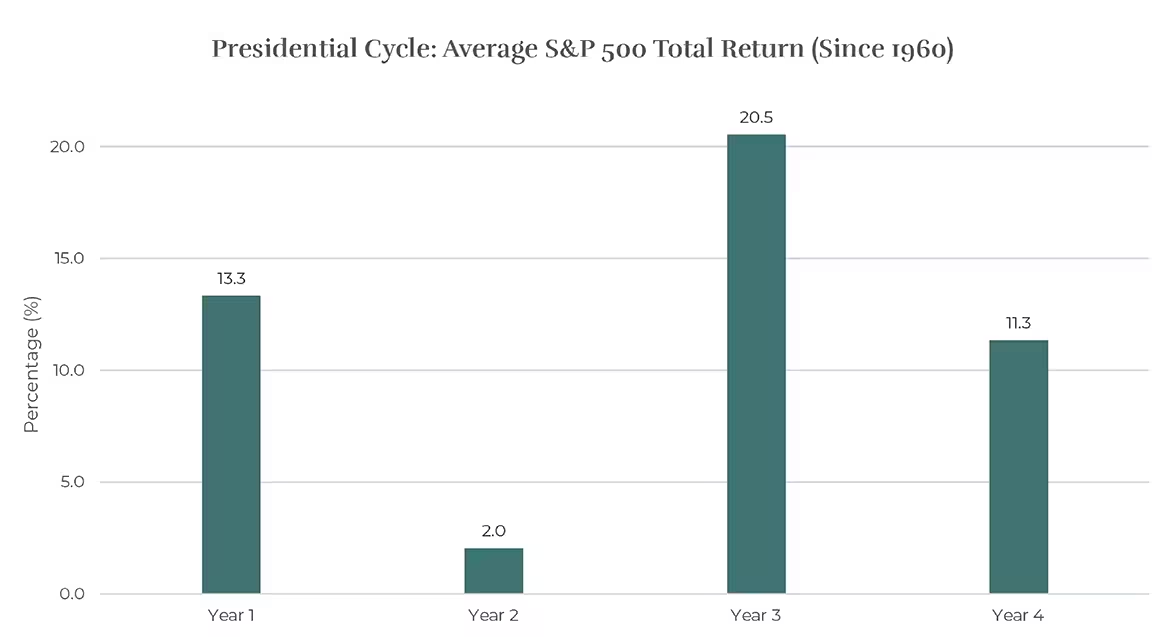

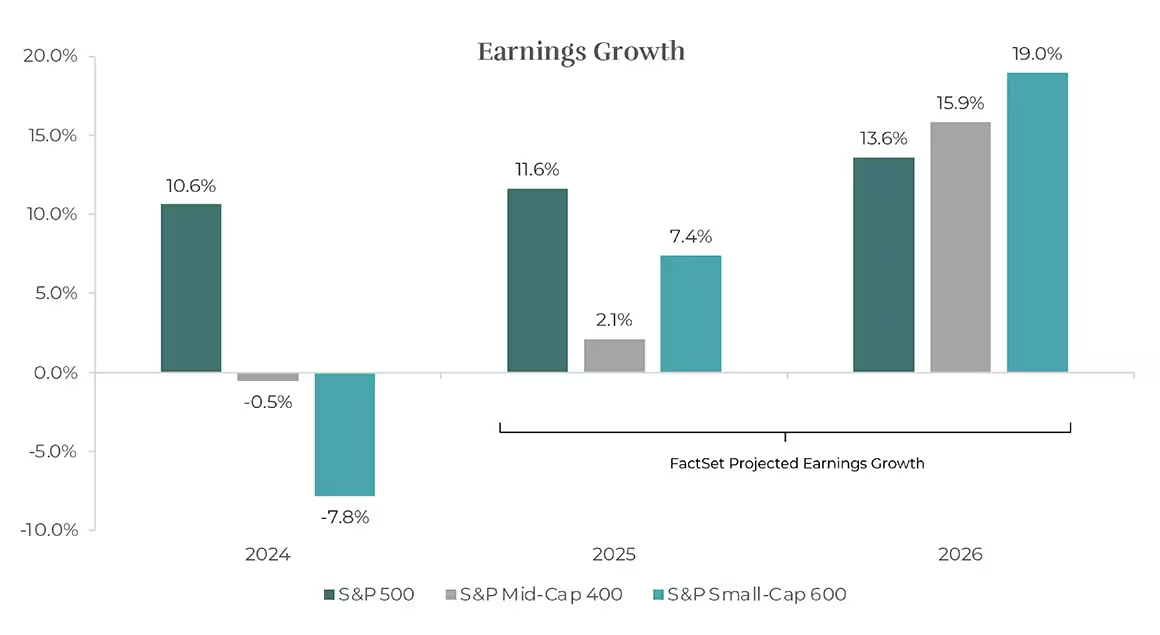

Equities ride into 2026 on elevated valuations and high expectations. The presidential cycle chart (Figure 2) reminds us that second years often bring weaker returns, but earnings growth projections remain robust — Figure 3 highlights double-digit growth for mid and small caps.

The “Magnificent Seven” AI-driven giants dominate large cap indexes, creating concentration risk. Yet beyond them, valuations are more reasonable, and diversification across sectors and regions is key. International equities provide balance, especially as U.S. tech valuations soar.

Figure 2: Presidential Cycle: Average S&P 500 Total Return (Since 1960)

Source: Cetera Investment Management, FactSet, Standard & Poor's. Returns shown are S&P 500 total returns, which include dividends. Investors cannot invest directly in indexes. Data as of 12/31/2024.

Figure 3: Earnings Growth

Source: Cetera Investment Management, FactSet, Standard & Poor's. Earnings growth is represented by the year-over-year change. 2025 and 2026 figures are projected by FactSet. Data as of 9/15/2025.

Bonds reclaim center stage in 2026. With yields attractive across the spectrum — 4.25% for government bonds, 4.75% for investment grade corporates, and nearly 7% for high yield — fixed income offers both return potential and portfolio stability.

We expect yields to remain range bound, with a tilt lower by year end, creating opportunities for price appreciation. Figure 4 shows tight high-yield spreads, signaling confidence in the economy but warranting caution. High-quality bonds stand out as diversifiers against equity risk.

Figure 4: High-Yield Spreads

Source: Cetera Investment Management, FactSet, Bank of America Merrill Lynch. Data as of 11/5/2025.

2026 is a year of resilience and elevated expectations. Tax cuts, consumer strength, and AI-driven productivity gains support growth, while equities demand careful navigation and bonds offer compelling diversification.

The charts tell the story — from household debt trends to earnings growth projections and high-yield spreads — but the full outlook reveals the deeper forces shaping markets.

Cetera Investment Management LLC is an SEC registered investment adviser owned by Cetera Financial Group®.

The material contained in this document was authored by and is the property of Cetera Investment Management LLC. Cetera Investment Management provides investment management and advisory services to a number of programs sponsored by affiliated and non-affiliated registered investment advisers. Your registered representative or investment adviser representative is not registered with Cetera Investment Management and did not take part in the creation of this material. He or she may not be able to offer Cetera Investment Management portfolio management services.

The content presented should not be construed as offering specific investment, tax, or legal advice and is not an offer or a solicitation of any services. Past performance is not a guarantee of future results.

Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision.

All economic and performance information is historical and not indicative of future results. The market indices discussed are not actively managed. Investors cannot directly invest in unmanaged indices. Please consult your financial advisor for more information. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

A diversified portfolio does not assure a profit or protect against loss in a declining market.