As we approach the five-year anniversary of the pandemic’s onset in the United States, the economy is still moderating toward pre-pandemic levels. The pandemic and its aftermath disrupted supply chains, labor markets, inflation, and economic growth, leading to significant fluctuations across these indicators. These effects have rippled through stock and bond markets, shaping economic conditions for years.

Stimulus funds are still circulating through the economy, though their impact has waned. Economic growth is decelerating, as is inflation, and the labor market is beginning to soften from historically strong levels. The Federal Reserve has now entered a rate–cutting cycle, moving interest rates closer to a neutral rate–a level we’ve rarely seen in the past 15 years. After the Great Financial Crisis and the pandemic, interest rates were slashed to zero, whereas recent Fed policy has been highly restrictive to combat inflation. Now, all these forementioned factors, particularly the Fed Funds rate, are becoming less extreme.

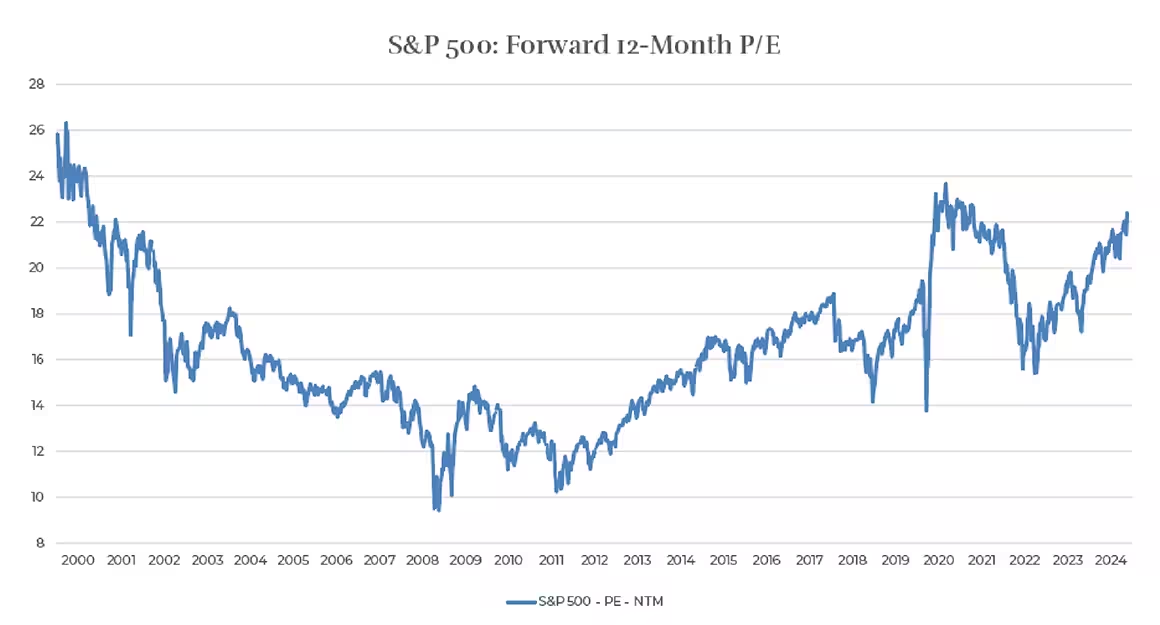

This theme of moderation extends beyond economic data and the Fed. In equities, we are seeing extreme concentrations within indexes, where a handful of stocks dominate and drive much of the index performance. These stocks have driven valuations upward, with their prices exceeding earnings by substantial multiples. In 2025, we may see a moderation in equities as other stocks gain ground, particularly smaller companies with more attractive valuations, which could benefit in a lower interest rate environment. What has performed well in the past may not perform as well in the future. Likewise, stocks that have lagged for years may finally start to outperform.

Source: Cetera Investment Management, FactSet, Standard & Poor’s. Investors Cannot Invest Directly in Indexes. Data as of 10/31/2024.

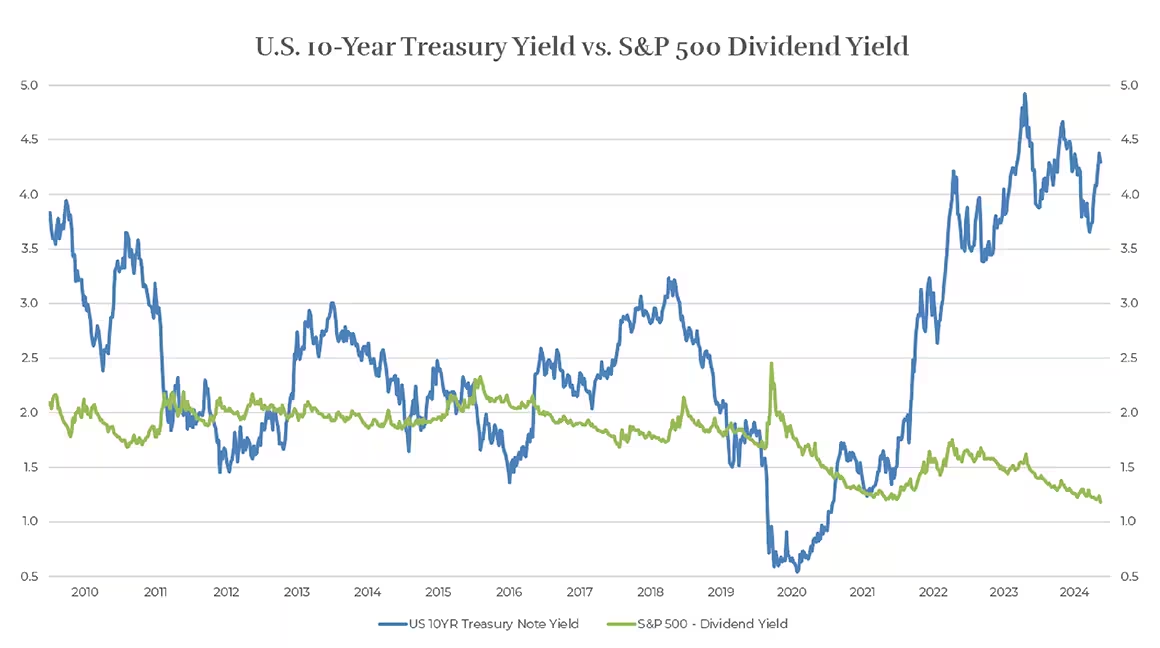

In bonds, we anticipate more moderation. The Treasury yield curve remained inverted for over two years–the longest in history–with shorter-term bonds yielding more than longer-term bonds. This inversion has ended, and we expect the curve to steepen as the Fed cuts rates, likely lowering short-term yields. While some bond market volatility is expected over the next year, returns may align with yields, plus a modest boost from price appreciation. As interest rates on savings accounts and money markets decline, bonds may be attractive to investors seeking better returns.

Source: Cetera Investment Management, FactSet, U.S. Treasury Department, Standard & Poor’s. Data as of 11/8/2024

Cetera Investment Management LLC is an SEC registered investment adviser owned by Cetera Financial Group®.

The material contained in this document was authored by and is the property of Cetera Investment Management LLC. Cetera Investment Management provides investment management and advisory services to a number of programs sponsored by affiliated and non-affiliated registered investment advisers. Your registered representative or investment adviser representative is not registered with Cetera Investment Management and did not take part in the creation of this material. He or she may not be able to offer Cetera Investment Management portfolio management services.

The content presented should not be construed as offering specific investment, tax, or legal advice and is not an offer or a solicitation of any services. Past performance is not a guarantee of future results.

Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision.

All economic and performance information is historical and not indicative of future results. The market indices discussed are not actively managed. Investors cannot directly invest in unmanaged indices. Please consult your financial advisor for more information. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

A diversified portfolio does not assure a profit or protect against loss in a declining market.