While mistakes are possible, it is more likely the Fed will end up being a friend in 2024 and, if an economic slowdown materializes, they would likely cut rates which should act as a backstop for markets. The general sentiment is anticipatory of rate cuts, including the Fed’s own dot plot which projects a lower federal funds rate by the end of next year.

While our Outlooks typically cover what we expect in the coming quarter or year, investing is typically done with a longer horizon in mind. The good news is the stage is currently set for long-term growth. That growth may not happen for a couple of years, but in the interim we may see certain themes develop. Timing these developments can be difficult: there can be setbacks along the way, and sometimes they develop so slowly you don’t necessarily notice them until it’s too late.

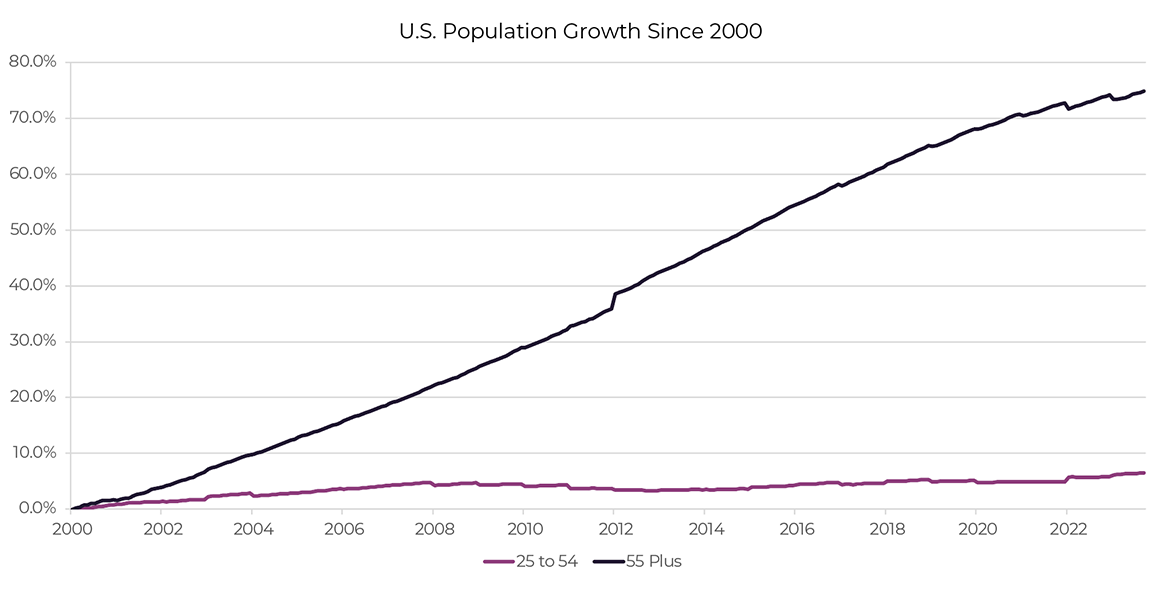

As the name implies, baby boomers created a surge in the population when they were born. But since then, population growth has slowed, and baby boomers are hitting retirement at an increasing rate. From January 2000 to September 2023, the population of those over 55 years old increased by 75%, or 42.8 million. Over that same period, the population of 25–54-year-olds (prime-age workforce) only increased by 6.5%, or 7.8 million. This has many implications, especially for the labor market.

With “Help Wanted” signs seemingly everywhere, and more job openings than people looking for work, one might question where all the workers went. In part, they retired, which is good news for them, but when paired with slowing population growth it creates a disparity that’s bad news for economic growth. This isn’t just a problem for the U.S.—it affects most developed countries, and it’s not going away any time soon. The silver lining is that with challenges come opportunities.

Source: Cetera Investment Management, Federal Reserve Bank of St. Louis, U.S. Bureau of Labor Statistics. Data as of 9/30/2023.

One opportunity came in the form of the CHIPS and Science Act, passed by Congress in August 2022 and providing roughly $280 billion in new funding to boost domestic research and manufacturing of semiconductors in the U.S. The race for artificial intelligence to boost productivity--and counterbalance the world’s aging population problem—has already begun. Additionally, as the aging population shifts from stocks to bonds for more stable income, they could play a role in lowering long-term bond yields. Lower bond yields are a catalyst for growth, good for bond prices, and thus good for bond returns.

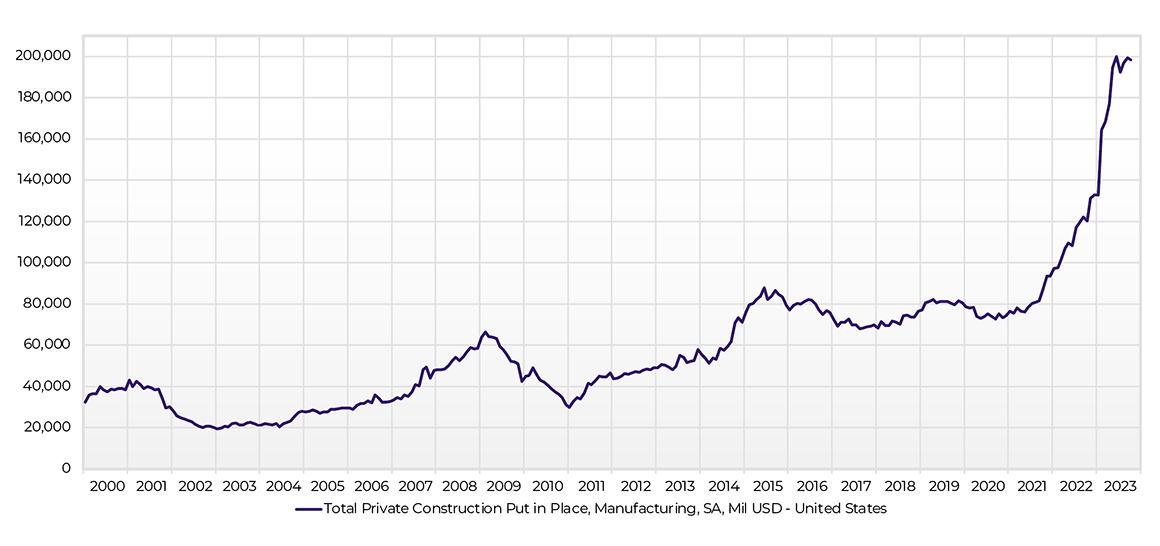

The U.S. may also be able to capitalize on lower energy prices and its ability to be energy independent with its abundance of cheap natural gas. As energy prices rise in Europe, it becomes more economical to manufacture and transport gas within the U.S. to accommodate its large base of customers. With the world increasingly conscious about carbon emissions, manufacturing goods in North America could become more advantageous. Add to that the fact that carbon emissions are a global problem, and exporting pollution to other countries with lower emissions standards may eventually gain added scrutiny. We are already seeing the groundwork for another domestic manufacturing boom, with construction spending on manufacturing facilities in the U.S. more than doubling since the start of 2022.

Source: Cetera Investment Management, FactSet, U.S. Census Bureau. Data as of 9/30/2023.

Cetera Investment Management LLC is an SEC registered investment adviser owned by Cetera Financial Group®.

The material contained in this document was authored by and is the property of Cetera Investment Management LLC. Cetera Investment Management provides investment management and advisory services to a number of programs sponsored by affiliated and non-affiliated registered investment advisers. Your registered representative or investment adviser representative is not registered with Cetera Investment Management and did not take part in the creation of this material. He or she may not be able to offer Cetera Investment Management portfolio management services.

The content presented should not be construed as offering specific investment, tax, or legal advice and is not an offer or a solicitation of any services. Past performance is not a guarantee of future results.

Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision.

All economic and performance information is historical and not indicative of future results. The market indices discussed are not actively managed. Investors cannot directly invest in unmanaged indices. Please consult your financial advisor for more information. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

A diversified portfolio does not assure a profit or protect against loss in a declining market.